Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

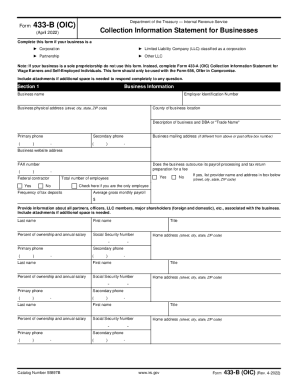

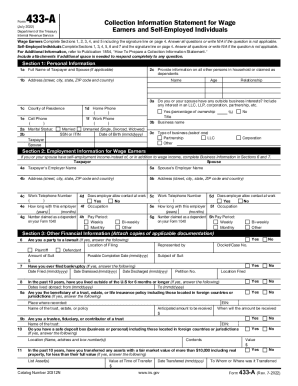

IRS Form 433 is an information collection form used by the IRS to collect financial information from taxpayers. The form is used by the IRS to help determine a taxpayer’s ability to pay taxes. It is used by the IRS to determine a taxpayer’s financial condition, including income, expenses, assets, and liabilities.

How to fill out irs form 433?

1. Fill out Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, or Form 433-F, Collection Information Statement for Businesses.

2. Enter your name, address, and Social Security number (or employer identification number) in the appropriate spaces.

3. Indicate the type of tax return you are filing and the tax year in question.

4. List all of your sources of income, including wages, self-employment income, unemployment compensation, interest, dividends, and other income.

5. List all of your expenses, including mortgage payments, rent, car payments, utilities, food, and medical expenses.

6. Enter detailed information about your assets, including the value of your house, car, investments, and other property.

7. Enter detailed information about your liabilities, including the amount of any secured and unsecured debts (credit cards, student loans, etc.).

8. Sign and date the form.

9. Mail the completed form to the IRS.

What is the purpose of irs form 433?

IRS Form 433 is used by individuals and businesses to provide financial information to the IRS. This form is used in cases of non-compliance with federal tax laws, in order to establish an installment payment plan or to negotiate the terms of an Offer in Compromise. The information provided on Form 433 helps the IRS determine whether an individual or business is able to pay their tax liabilities and if an installment payment plan or Offer in Compromise is appropriate.

What is the penalty for the late filing of irs form 433?

The penalty for the late filing of IRS Form 433 is 5% of the unpaid balance for each month or part of a month the tax remains unpaid, up to a maximum of 25%.

Who is required to file irs form 433?

Form 433 is used by individuals and businesses who owe taxes to the Internal Revenue Service (IRS) and are seeking some form of resolution, such as a payment plan or an offer in compromise. Therefore, those who owe taxes to the IRS and are seeking a resolution may be required to file Form 433.

What information must be reported on irs form 433?

IRS Form 433 is used to gather financial information from individuals or businesses that owe unpaid taxes or have outstanding tax debt. The form is used to determine an individual or business's ability to pay the taxes owed and set up a repayment plan.

The following information must be reported on IRS Form 433:

1. Taxpayer Information: Name, address, social security number/tax ID number, and contact information.

2. Income: Details of all sources of income, including wages, self-employment income, rental income, retirement income, and any other type of income received.

3. Expenses: Details of all monthly living expenses, including rent or mortgage payments, utilities, transportation costs, groceries, health care expenses, child support or alimony payments, and any other regular expenses.

4. Assets: Information about all assets owned, including real estate, vehicles, bank accounts, investments, retirement accounts, life insurance policies, and any other assets with a significant value.

5. Liabilities: Details of all debts, loans, and obligations, including credit card debt, student loans, medical bills, mortgages, car loans, and any other outstanding debts.

6. Financial Statements: Current bank statements, brokerage statements, and supporting documentation showing the balances and activities of the accounts.

7. Employment Information: Details of current employment, including the name and address of the employer, job title, salary or wages earned, and any other relevant employment details.

8. Business Information (if applicable): Information about the business, including the name, address, type of business, structure (sole proprietorship, partnership, corporation), and financial details such as income and expenses.

9. Additional Information: Any additional information or documentation that the IRS requests to accurately assess the taxpayer's financial situation.

It's important to note that Form 433 may have different versions depending on the specific circumstances or type of tax debt being addressed, such as Form 433-A (for individuals), Form 433-B (for businesses), or Form 433-F (for installment agreement requests).

When is the deadline to file irs form 433 in 2023?

The deadline to file IRS Form 433 can vary depending on the specific circumstances and the type of form being filed. Generally, Form 433 is used for various purposes such as collection information statements, installment agreements, and offers in compromise. These forms may have different deadlines depending on the situation.

To accurately determine the specific deadline for filing Form 433 in 2023, it is important to consult the IRS website or contact the IRS directly for the most up-to-date and accurate information.

How can I send 433 b irs form for eSignature?

To distribute your form 433 b, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make edits in 433 b without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing form 433 b irs and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the 433b blank in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.